Pawlenty's Budget Policy: Anti-Jobs, Anti-Small Business

As the State of Minnesota faces more red ink, Governor Pawlenty has stated he will "strive to be more business and job friendly" while planning "to address the deficit through spending cuts alone."

The effect of his budget policy, however, has been to punish small businesses, especially the ones that are hanging on the edge during this recession. When Pawlenty's further shifting of the tax burden from state to local governments forces even more businesses to close their doors, the result will be more job losses, a longer economic downturn, and even more budget woes for the whole state in the future.

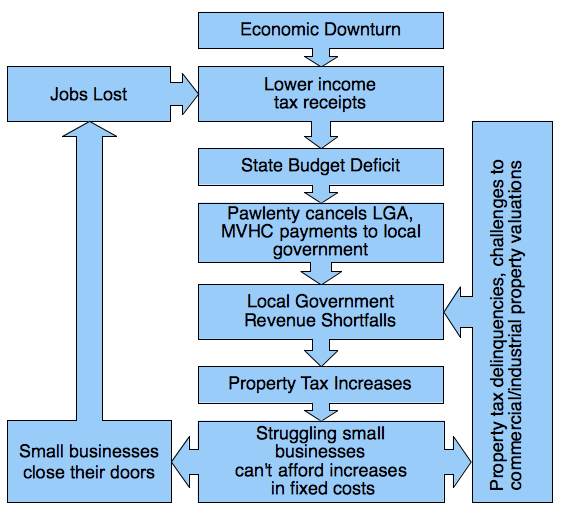

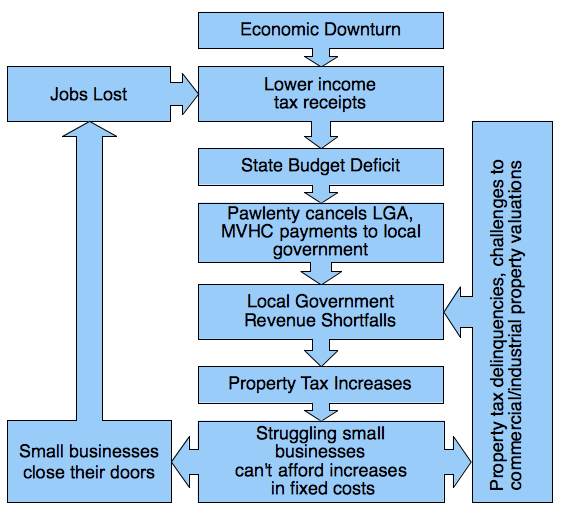

Here's a flowchart of cause and effect to explain what I mean:

A business pays income taxes based on profit. If times are lean, a corporation is not paying these taxes. In contrast, regardless of the health of a company, its property taxes are a fixed dollar amount. So Pawlenty's supposedly "pro-business" policies — refusing to raise taxes at the state level, and cutting payments to local government — have the effect of preserving the profits of the healthiest companies (those paying income taxes) at the expense of the small business at the margin (the ones who might only be breaking even or swallowing a loss this year).

A business pays income taxes based on profit. If times are lean, a corporation is not paying these taxes. In contrast, regardless of the health of a company, its property taxes are a fixed dollar amount. So Pawlenty's supposedly "pro-business" policies — refusing to raise taxes at the state level, and cutting payments to local government — have the effect of preserving the profits of the healthiest companies (those paying income taxes) at the expense of the small business at the margin (the ones who might only be breaking even or swallowing a loss this year).

If you're a fan of bigger, more consolidated businesses (who are happy to buy up the shells of their former competitors on the cheap) and less competition and diversity in the marketplace, maybe you see this as a good thing. Economic cataclysms do, after all, create incredible money-making opportunities for those in a position to take Baron Rothschild's advice and "buy when there's blood in the streets."

However, I think it's terrible policy for everyone in the long run. Already-profitable businesses can be more profitable if they have more customers — in the form of other surviving businesses with money to spend on operations and invest in growth, and consumers with jobs and income to spend.

The answer to the state's budget crisis is not to rely only on increases in personal and corporate income taxes, of course, but it needs to be part of the mix in a pragmatic strategy for recovery. Unfortunately, our governor appears unwilling to substitute a little political courage for his presidential ambitions.

As it stands, the governor's "pass the buck" tax policy consists of taking from those in need for the benefit of those who have plenty — whether we're talking about his cuts to medical assistance, or LGA/MVHC cuts that have the effect of shifting tax burdens from thriving (income tax-paying) companies to those that are struggling.

His policy is neither just nor sound for the health of Minnesota's economy.

The effect of his budget policy, however, has been to punish small businesses, especially the ones that are hanging on the edge during this recession. When Pawlenty's further shifting of the tax burden from state to local governments forces even more businesses to close their doors, the result will be more job losses, a longer economic downturn, and even more budget woes for the whole state in the future.

Here's a flowchart of cause and effect to explain what I mean:

A business pays income taxes based on profit. If times are lean, a corporation is not paying these taxes. In contrast, regardless of the health of a company, its property taxes are a fixed dollar amount. So Pawlenty's supposedly "pro-business" policies — refusing to raise taxes at the state level, and cutting payments to local government — have the effect of preserving the profits of the healthiest companies (those paying income taxes) at the expense of the small business at the margin (the ones who might only be breaking even or swallowing a loss this year).

A business pays income taxes based on profit. If times are lean, a corporation is not paying these taxes. In contrast, regardless of the health of a company, its property taxes are a fixed dollar amount. So Pawlenty's supposedly "pro-business" policies — refusing to raise taxes at the state level, and cutting payments to local government — have the effect of preserving the profits of the healthiest companies (those paying income taxes) at the expense of the small business at the margin (the ones who might only be breaking even or swallowing a loss this year).If you're a fan of bigger, more consolidated businesses (who are happy to buy up the shells of their former competitors on the cheap) and less competition and diversity in the marketplace, maybe you see this as a good thing. Economic cataclysms do, after all, create incredible money-making opportunities for those in a position to take Baron Rothschild's advice and "buy when there's blood in the streets."

However, I think it's terrible policy for everyone in the long run. Already-profitable businesses can be more profitable if they have more customers — in the form of other surviving businesses with money to spend on operations and invest in growth, and consumers with jobs and income to spend.

The answer to the state's budget crisis is not to rely only on increases in personal and corporate income taxes, of course, but it needs to be part of the mix in a pragmatic strategy for recovery. Unfortunately, our governor appears unwilling to substitute a little political courage for his presidential ambitions.

As it stands, the governor's "pass the buck" tax policy consists of taking from those in need for the benefit of those who have plenty — whether we're talking about his cuts to medical assistance, or LGA/MVHC cuts that have the effect of shifting tax burdens from thriving (income tax-paying) companies to those that are struggling.

His policy is neither just nor sound for the health of Minnesota's economy.

Labels: finance

Post a Comment